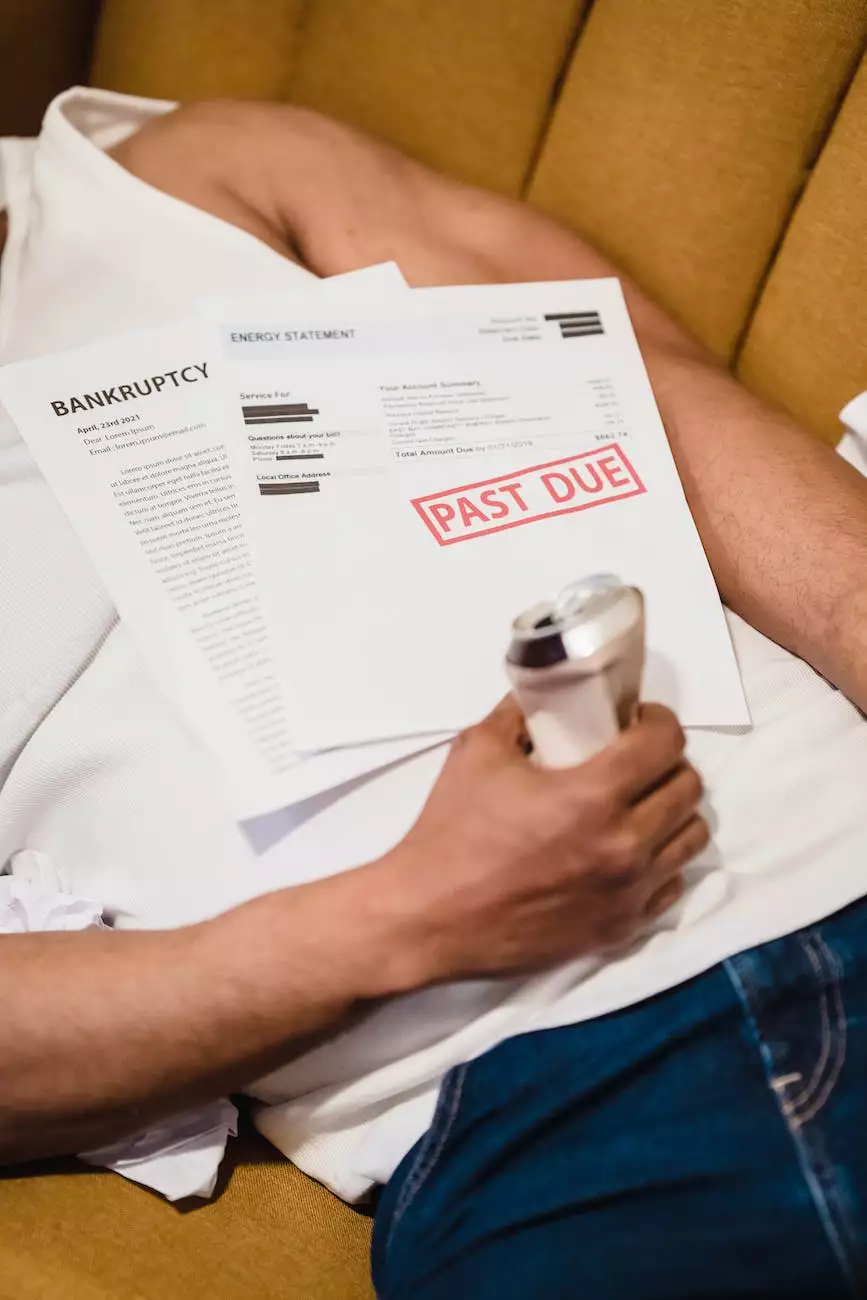

Reaffirmation Of Debt

Practice Areas

At Troy Powell Law Firm, we understand that navigating the complex world of debt reaffirmation can be overwhelming. Our team of highly skilled attorneys specializes in providing comprehensive legal support for clients seeking to reaffirm their debts. Whether you are an individual or a business owner, we are here to guide you through this intricate process and protect your best interests.

Understanding Reaffirmation Of Debt

Reaffirmation of debt refers to the process by which a borrower affirms their commitment to repay a specific debt in full, despite filing for bankruptcy. This legal process allows individuals and businesses to maintain possession of certain assets secured by debts, such as homes or vehicles, by entering into a reaffirmation agreement with the lender.

Reaffirmation can offer several benefits, including the ability to keep your property and maintain a positive credit history. However, it is crucial to understand the implications and potential risks involved in this process. Working with an experienced attorney, such as those at Troy Powell Law Firm, can help ensure that you make informed decisions throughout the reaffirmation process.

How We Can Help

At Troy Powell Law Firm, our dedicated team of attorneys has extensive experience in handling reaffirmation of debt cases across a wide range of industries. We work closely with our clients to understand their unique circumstances and tailor our legal strategy accordingly. Our goal is to provide personalized guidance and effective representation that delivers the best possible outcome.

Comprehensive Legal Support

Our team excels in providing comprehensive legal support throughout the entire reaffirmation process. We will carefully review your financial situation, evaluate your debts, and help you understand the potential implications of reaffirmation. By analyzing your specific circumstances, we can help you determine whether reaffirmation is the right choice for you.

Negotiation and Drafting of Reaffirmation Agreements

Should you choose to proceed with reaffirmation, the attorneys at Troy Powell Law Firm will negotiate with the lender on your behalf. We will strive to secure the most favorable terms for you, taking into account factors such as interest rates, repayment schedules, and potential modifications. Our team will ensure that the drafted reaffirmation agreement aligns with your best interests and complies with all legal requirements.

Protection Against Unfair Practices

Unfortunately, some lenders may engage in unfair practices during the reaffirmation process, attempting to take advantage of borrowers. At Troy Powell Law Firm, we are well-versed in identifying and challenging such practices. Our attorneys will diligently protect your rights and ensure that you are treated fairly throughout the process.

Why Choose Troy Powell Law Firm?

When it comes to navigating the complexities of reaffirmation of debt, choosing the right legal team is essential. Here are a few reasons why clients continue to trust Troy Powell Law Firm:

- Years of Experience: With years of experience in handling debt reaffirmation cases, our attorneys have developed a deep understanding of the legal nuances involved in the process.

- Personalized Approach: We recognize that every client's situation is unique. That's why we provide personalized attention and customize our legal strategy to suit your specific needs and goals.

- Extensive Network: Our firm has established a strong network of industry professionals, including financial advisors and credit counselors, who can provide additional support and insights throughout the reaffirmation process.

- Proven Track Record: Our track record speaks for itself. We have successfully helped numerous clients achieve their desired outcomes in reaffirmation cases, earning their trust and satisfaction.

At Troy Powell Law Firm, we are committed to assisting you every step of the way. Contact us today to schedule a consultation with one of our experienced attorneys, and let us navigate the reaffirmation of debt process together.