Required Documents For Chapter 7 Bankruptcy Filing

Practice Areas

Introduction

Welcome to Troy Powell Law Firm, your trusted legal partner in navigating the complexities of Chapter 7 bankruptcy filing. In this comprehensive guide, we will provide you with all the information you need to understand the required documents for a successful Chapter 7 bankruptcy petition. Our team of legal experts is committed to assisting you through every step of the bankruptcy process, ensuring that you have a fresh financial start.

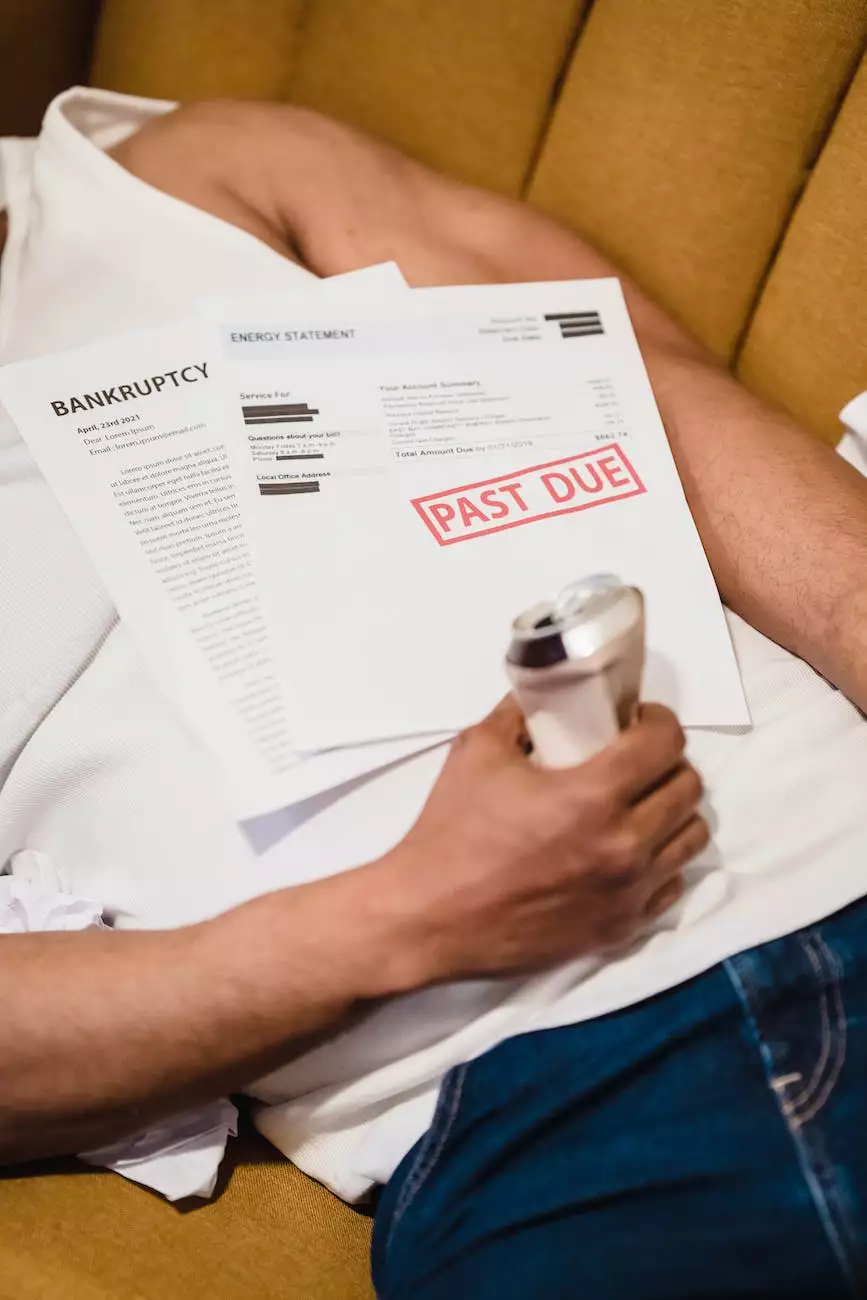

Chapter 7 Bankruptcy Overview

Chapter 7 bankruptcy, also known as liquidation bankruptcy, provides individuals and businesses overwhelmed with debts an opportunity to eliminate most of their obligations and start anew. However, to initiate the Chapter 7 bankruptcy process, specific documents must be gathered and submitted to the court.

Required Documents

Below, we have outlined the essential documents you will need when filing for Chapter 7 bankruptcy:

1. Proof of Income

Documentation of your current monthly income is crucial in determining your eligibility for Chapter 7 bankruptcy. Prepare copies of your pay stubs, tax returns, W-2 forms, and any other documents that accurately reflect your income over the past six months.

2. List of Assets and Liabilities

You must provide a detailed inventory of all your assets and liabilities, including bank statements, investment account statements, real estate deeds, vehicle titles, and any other relevant documentation. Remember to include information about any debts, loans, and credit accounts.

3. Credit Counseling Certificate

Prior to filing for Chapter 7 bankruptcy, you must complete credit counseling from an approved agency. Include a copy of your credit counseling certificate with your bankruptcy documents.

4. Bank Statements

Obtain copies of your bank statements from all your financial accounts, including checking, savings, and investment accounts. These statements should cover the most recent six months.

5. Tax Returns

Ensure you have copies of your previous year's federal and state tax returns. These returns will help assess your financial situation and determine your potential tax liabilities.

6. Proof of Identification

Include a valid and unexpired form of identification, such as a driver's license or passport, to verify your identity when filing for bankruptcy.

7. Loan Repayment Plan

If you have any outstanding loan repayment plans, gather the related documents and information to ensure these obligations are properly addressed during the bankruptcy process.

Conclusion

By providing the necessary documents for Chapter 7 bankruptcy filing, you are taking the first step towards financial freedom. Remember, this is just a general overview, and each bankruptcy case is unique. It is crucial to consult with an experienced bankruptcy attorney, like those at Troy Powell Law Firm, to analyze your situation and guide you through the process impeccably.

Put your trust in Troy Powell Law Firm, a reputable name in bankruptcy law. With our expertise and dedication, we will do everything within our power to help you secure a fresh start.